Last Updated : 25/05/21

Page contents

- Introduction

- Voice search performance

- Actions & Skills use cases

- Amazon / Google 1st party

- Existing skills/actions

- Other

- Policy Restrictions

- Main takeways

Introduction to voice in the insurance industry

By 2025, the digital voice assistant software market is expected to reach over a billion users. With increasing adoption of voice interaction worldwide, and 46% of insurance seekers reporting using voice search at least once a day, there is a significant opportunity for the Insurance industry to use voice apps to reduce friction and simplify the customer experience. Several well-known brands, including Aviva, InsureandGo and Cigna and more, have already built voice apps to take advantage of the increasing adoption of voice technology.

Key challenges for the insurance industry:

- High competition with lack of differentiation between providers

- High load on call centres, with most major insurers employing thousands of people to field questions from customers

- Lack of personalisation and low perceived value

How to optimise your website for voice

The first step in your voice optimisation strategy should be checking how your website performs for informational queries, e.g. “new driver insurance”, “what is international health insurance”, etc.

Voice Search Performance

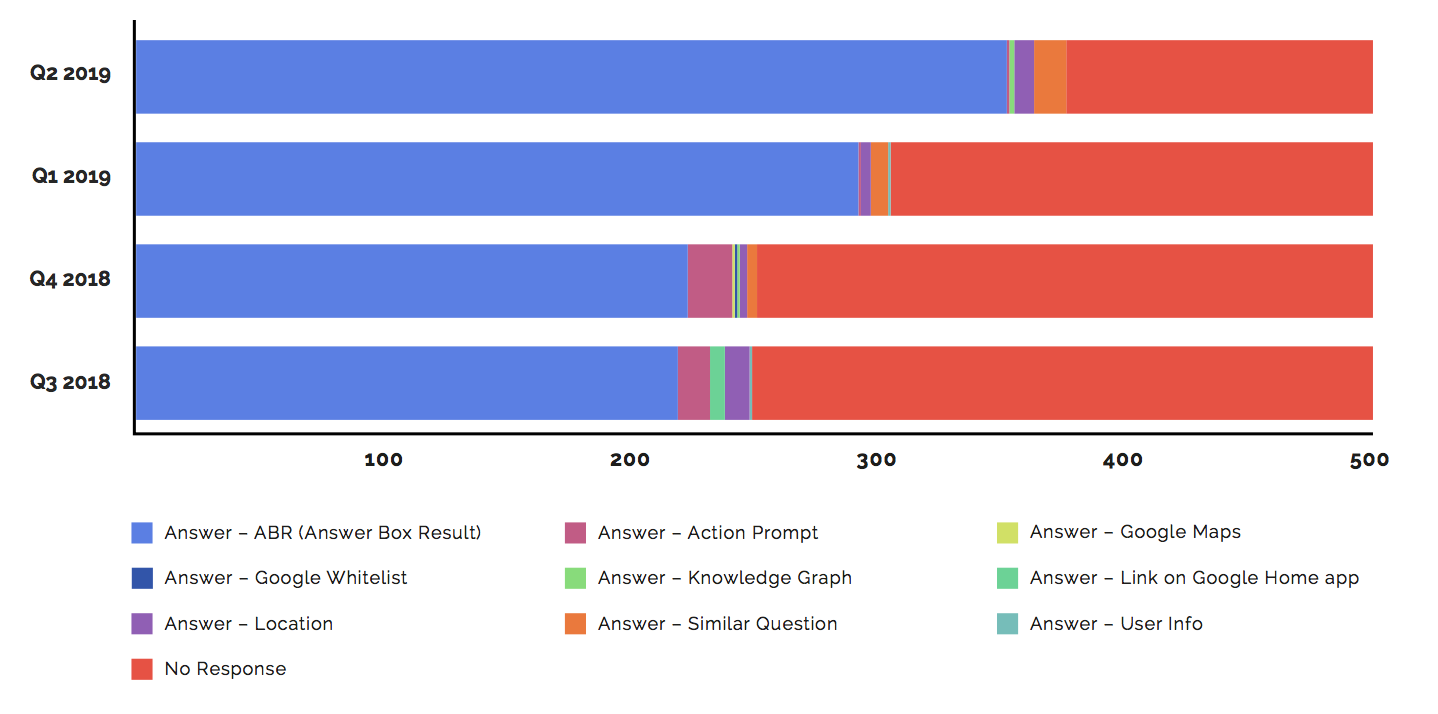

The Google Assistant has recently become far better at answering queries about insurance, with its ability to answer improving from 61% to 75% between Q1 and Q2 2019.

This is mainly due to the Google Assistant returning more answers from standard Answer Box results.

Actions & Skills

Actions (on the Google Assistant) and skills (on Alexa) are voice-enabled apps which extend the built-in functionality of these voice assistants. While optimising your website for voice can provide a one-way snippet of information, actions and skills can allow brands to create two-way conversations with their consumers and can help them to perform tasks and activities.