Last Updated : 24/05/21

Page contents

- Introduction

- Voice search performance

- Actions & Skills use cases

- Amazon / Google 1st party

- Existing skills/actions

- Chatbots

- Other

- Policy Restrictions

- Main takeways

Introduction to voice in the finance industry

By 2021, smart speaker sales are expected to overtake tablet sales, with 55% of householdsowning one by the following year. The rise in usage of voice assistants, such as Amazon Alexa and the Google Assistant, could completely change the way consumers search for and engage with financial information. In many cases, voice provides a much faster way to complete tasks than by typing and, within the finance and banking industry, there is increasing focus on using voice assistants to improve customer servicing and account management, from companies such as Capital One, PayPal, Experian and others.

Key challenges for the finance industry:

- Low satisfaction rate with long call wait times and laborious identity screening process

- High load on call centres for simple queries & actions

- Increasing demand for advice-driven banking, rather than a purely transactional relationship

- Decreasing customer loyalty with increasing competition

How to optimise your website for voice

The first step in your voice optimisation strategy should be checking how your website performs for informational queries, e.g. “best savings accounts”, “what is a good credit score”, etc.

Voice Search Performance

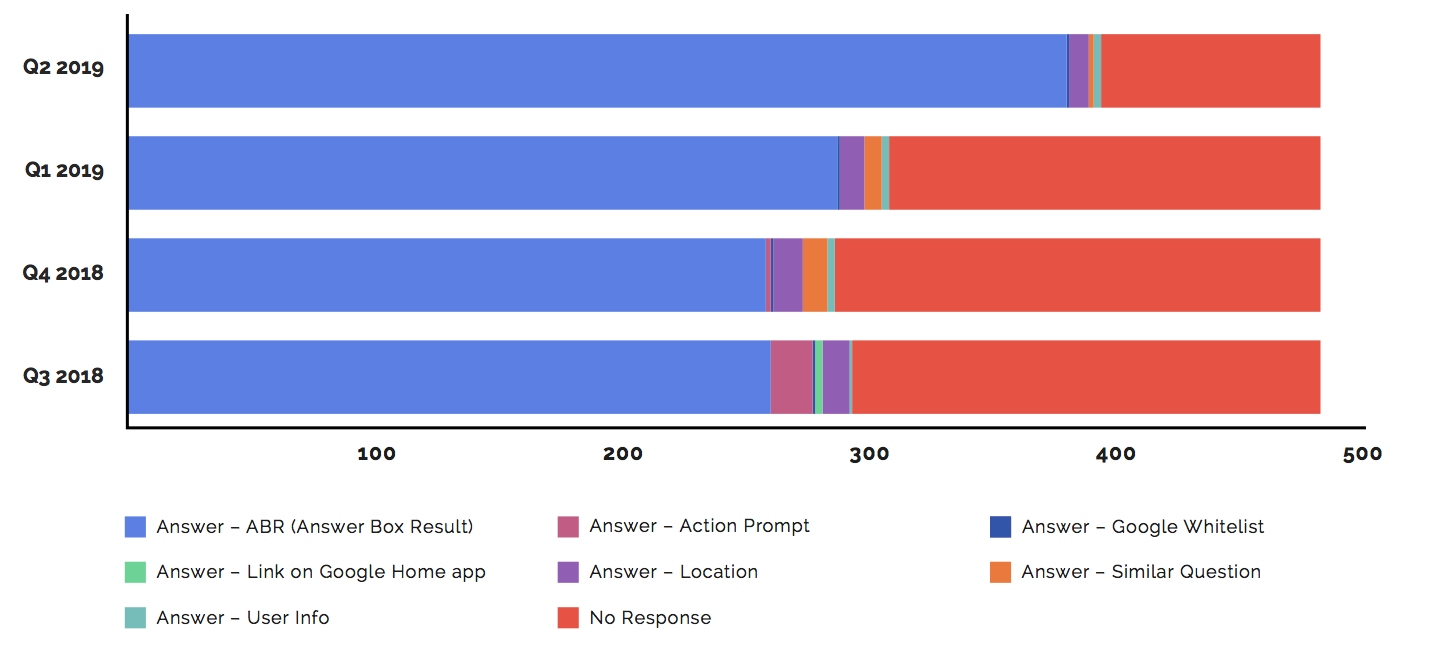

The Google Assistant has recently become far better at answering queries about finance, with its ability to answer improving from 65% to 82% between Q1 and Q2 2019.

This is mainly due to the Google Assistant returning more answers from standard Answer Box results.

Actions & Skills

Actions (on the Google Assistant) and skills (on Alexa) are voice-enabled apps which extend the built-in functionality of these voice assistants. While optimising your website for voice can provide a one-way snippet of information, actions and skills can allow brands to create two-way conversations with their consumers and can help them to perform tasks and activities.